Giving FAQs

Here are the most Frequently Asked Questions we’re asked about giving through National Zakat Foundation.

You can select one of the following categories to help you find the answer you’re looking for.

About Zakat and other types of donation

How do you distribute my Zakat?

If your question isn’t covered here, please get in touch with ourselves via this page here and we’ll be in touch as soon as possible.

About Zakat and other types of donation

What is Zakat?

- Zakat is one of the five pillars of Islam. Zakat means purification, blessing and growth.

- Muslims with a certain amount of wealth must give a small amount (2.5%) of that wealth to help other Muslims in need.

- Zakat is viewed as a right of those who should receive it, and a necessary act to cleanse the wealth of those able to give it.

What is Sadaqah?

- Sadaqah is a voluntary charitable act towards another being. The act may be financial but can be other things too. A good deed, a helping hand and a smile are all acts of Sadaqah.

What is Zakat ul Fitr? How much is it?

- Zakat ul Fitr is obligatory charity which is paid before Eid-ul-Fitr at the end of the month of Ramadan. This is so that poor Muslims will be able to enjoy Eid.

- It must be paid by every Muslim if the total value of his/her Zakatable assets (cash, gold, silver, merchandise) plus non-essential items (i.e. assets above their basic needs) minus liabilities (debts) equals or exceeds Nisab (the minimum amount that a Muslim must have before being obliged to give zakat). A person must also pay Zakat ul Fitr on behalf of all children under their care.

- The quantity is described by the Prophet (SAW) as one saa’ of food – equal to four scoops when one puts their hands together. The equivalent amount of money is £7.

What is Fidyah? How much is it?

- If a person is unable to fast, they can make up the fast later.

- If a person is unable to fast and will not be able to make up the fast later (e.g. due to long term illness), they must pay Fidyah.

- The amount is £7 for each missed fast: this can provide one person with a meal.

What is Kaffarah? How much is it?

- If a person misses or breaks their fast without reason, they must fast continuously for 60 days.

- If a person misses or breaks their fast without reason and can’t fast continuously for 60 days, they must pay kaffarah for each missed/broken fast.

- The amount is £420 for each deliberately missed/broken fast: this can provide 60 people with a meal at a rate of £7 per person.

Is my duty to pay Zakat fulfilled the moment I have given it, or only when it is received by the individual in need?

- Your Zakat obligation is fulfilled once NZF has received it.

- When NZF receives your Zakat, NZF is taking receipt on behalf of the applicant.

- This is because NZF UK is set up to represent recipients and act in the interests of the recipients through an agreement signed by applicants.

About NZF

What is the National Zakat Foundation (NZF)?

- NZF enables individual Muslims in the UK to give Zakat to individual Muslims who need support here in the UK: unlocking the potential of those held back by their financial circumstances and helping to get their lives back on track.

- NZF supports givers with the calculation of their Zakat; enables givers to choose the fund they wish to give to and whether they wish to use any of their Zakat to contribute towards the cost of getting it to the individuals in need; accepts and vets applications and distributes Zakat through cash grants to people eligible; and tracks the giving.

- You can get more information on NZF, the team and how we work on this page here: https://nzf.org.uk/about-nzf/

How do I know I can trust you with my Zakat?

- Scholars endorse us: our approach to distributing Zakat is certified as sound by the UK Islamic Shariah Council and Markaz al-Iftaʾ wa’l-Qadaʾ, the Centre for Religious Rulings & Mediation. Mufti Faraz Adam from NZF Worldwide and Mufti Amjad from Markaz al-Iftaʾ wa’l-Qada check and advise on our distribution regularly. See our certifications here.

- We’ve been awarded a 4-star rating by external evaluator Charity Clarity. The evaluator has rated all Charities evaluated by them on average as 3-star.

- Every year the auditor Sayer Vincent has given us a clearly positive (“unqualified”) audit opinion about our finances. They describe our governance as ‘strong’. Here’s a link to our Annual Report.

- We’re transparent: Our processes and criteria are publicly available, here. We provide regular, clear updates on how and where we are giving out Zakat overall through Zakat Live. We now give you a personalised update about who your Zakat has been able to help (with no names given of course!). Learn more about ZakaTracker here.

- We’re committed and consistent: NZF has many years of experience in getting your Zakat to individual Muslims in need across the UK. We helped over 12,000 people in need in 2021. We’ve helped over 42,000 people in need since 2011. See “Your Impact” for more details.

- Other givers are convinced: last year over 8,000 people in the UK trust us with their giving. In 2022, Islamic Relief have been so satisfied with the way we have historically distributed their givers’ Zakat, that they gave us a further £100,000 Zakat to distribute. See more information of our work with Islamic Relief here

Why do people in the UK need Zakat? Why do you only give to people in the UK?

- Many Muslims in the UK live in poverty. According to this MCB report, 50% of Muslim households are in poverty, compared with 18% of the general population.

- We have more of a responsibility to those who are closest to us. Beyond the scope of international relations and emergency situations, Islamic jurists agree that believers in a specific region hold a core responsibility to one another, and the needy of the land in which Zakat is collected have more rights over those in another land.

- We help people who give Zakat (who are almost all) in the UK to get their Zakat directly to people in need in the UK. NZF are running a positive ecosystem, helping us all towards a thriving, closer community.

- We also understand the details and situation of local people better than we can understand the situation of those who are further away. We are in a better position to know how to help those who are closer to us.

- Many scholars, leaders and community champions struggle to do their work for the Muslim community due to lack of training and investment.

How much of my Zakat do you spend on admin?

- We use all Zakat for charitable activity. We do not use Zakat to raise funds or for core costs.

How much do you spend on admin?

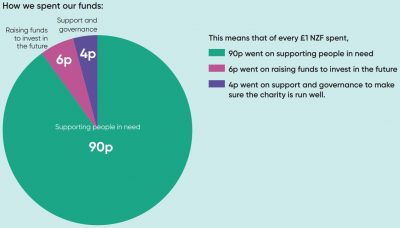

- The answer is just 4p in every £1 is spent on admin – support and governance to make sure the charity is run well. We don’t use your Zakat for this.

- And every £10 spent on raising funds raises at least £50 to invest in the future. That’s at least an extra £40 on top of your £10! We don’t use your Zakat for this either.

- Overall, of every £1 NZF spends, we spend 90p on charitable activity.

- Of the other 10p, 4p is on support and governance and 6p goes towards raising more funds. We cover all these costs from donations earmarked for that purpose, Sadaqah, Gift Aid and Riba.

- A more important question is: is your donation being used effectively? At National Zakat Foundation we work hard to make sure your donation is used wisely. We know we’re accountable to you – as well as to the recipients of your Zakat and most importantly, to Allah (swt) – so that’s why we let you know exactly when your own Zakat reaches recipients in need and how it helps them. And scholars audit our Zakat distribution to give you extra peace of mind.

What's your distribution service? Is it admin?

- When we send flowers to a friend, we choose a company that does more than just find a bunch of flowers – we want the florist to choose them carefully, wrap them and send them. That’s not admin, that’s a service. When charities collect, check, pack and send emergency aid in a truck, that’s not admin, that’s a service too.

- Our Zakat distribution service checks Muslims who apply for help are genuinely in need, and takes great care to get your Zakat directly to them. When you give Zakat, we check applications from people in need. We check they are genuine, using technology such as Open Banking. We check they are eligible for Zakat. We take care to work with the person in need to get them financial support as quickly and directly as possible. When a Muslim in the UK is in need, our infrastructure means we can support them regardless of whether they are in Plymouth, Belfast, or even Inverness! (You can have a look here!). That’s not admin, that’s a Zakat distribution service, just for you! NZF gives you the choice to contribute to your Zakat distribution service through Zakat or Sadaqah.

- Scholars have developed NZF’s Zakat Distribution Policy. This policy has been certified as sound by UK’s Islamic Shari’a Council and by Mufti Amjad Mohammed of Markaz al-Iftaʾ wa’l-Qada. You can find more information and the certificates here: https://nzf.org.uk/about-nzf/policies/

Why aren’t all staff salaries funded out of Gift Aid?

- We use Gift Aid to pay for the salaries of staff that support the organisation, including Marketing and Finance. We use Gift Aid to pay for regular costs such as IT and professional services such as audit fees. We also use Gift Aid towards maintaining and developing the technology to provide a great service to applicants and givers. We review our costs regularly and make every effort to keep all our costs to a minimum.

- Many givers do not ask us to claim back Gift Aid on their donation. That means we do not receive enough Gift Aid right now to cover the salaries of those staff whose job it is to get your Zakat to those who need it.

How do you use Riba?

- We use Riba to help towards core costs of the organisation, which in addition to Sadaqa funds enable us to stay sustainable. We have scholarly support for this policy.

- We do not give Riba to people in need of support.

- We keep track of each income type meticulously. We use different bank accounts, keeping income for directly helping recipients separate from other income.

How do you use Sadaqah?

- We use donations of Sadaqah (voluntary giving) to make your giving go further. Each £10 of Sadaqah can raise over £50 of Zakat to help even more Muslims in need. We also use sadaqah to increase capacity and improve the quality of our service.

- We don’t use Zakat to raise funds.

How do you use Zakat ul Fitr?

- We make sure all your Zakat-ul-Fitr goes to people in need in the UK who apply to the Hardship Fund for support and whom we have checked are eligible for help. They will receive your Zakat-ul-Fitr during Ramadan, in time for Eid.

What’s the latest I can pay Zakat ul Fitr through NZF?

- We make sure each eligible recipient receives Zakat-ul-Fitr in their bank account by the day before Eid at the latest – i.e. by the 28th of Ramadan, so they can benefit from Zakat-ul-Fitr on Eid.

- You can pay Zakat-ul-Fitr through NZF right up until the end of Thursday 27 April 2022. Unfortunately, we aren’t able to accept your payment beyond then, as due to the public holiday we can’t guarantee that recipients will receive any later contributions in time for Eid.

Thinking about giving

Can I give my Zakat to help people in my local area?

- We’re making improvements to the way we get your Zakat to those in need all the time. Right now, we’re not able to offer you the choice to give to a specific geographical area. We hope we can make this possible t in the near future. You can see you how many people we have been able to help in your area, thanks to the Zakat you and others have given, on this page here.

- You can choose how your Zakat is split across our three funds (Hardship Relief, Housing & Work, Education).

I can’t give online due to technical issues on the website. What can I do?

- You can give your Zakat via bank transfer: have a look at our “Other Ways to Give” page here and click on the “Giving Form”.

- Or if you want to finish giving online on the website, then get in touch with us via email from this page here and let us know what happened. We’ll get back to you within 2 working days.

Can I give to NZF in any other way apart from with Zakat?

- You can make a one-off or regular donation of Sadaqah (voluntary donation). Every £1 of Sadaqah helps us raise over £5 of Zakat, allowing NZF to help even more Muslims in need.

- You can give your Riba (interest).

- You can give Fidyah/Kaffarah

- In Ramadan, you can give Zakat-ul-Fitr.

- You can spread the word about what NZF does to friends, family, and other people you know, either in person or on social media.

What can I do if I know a Muslim in need?

- If you know someone who needs to receive Zakat, let them know they can apply online for support https://nzf.org.uk/apply-for-zakat/. You can help them apply if they need help.

How do I choose how to allocate my Zakat if I want to give by bank transfer or cheque?

- You can let us know how you want your Zakat to be used by completing our Giving Form here.

Do I need to add Gift Aid to my donation?

- If you can add Gift Aid your donation, it increases the value of your donation by 25% at no extra cost to you. £1 becomes worth £1.25. If you are a UK taxpayer, choose to ‘Gift Aid’ your donation (by checking the box online or ticking the box on a donation form) so your donation will go even further.

- Gift Aid can be added to your donation if you are donating your own money. Gift Aid can’t be added to your donation if you are paying donations you collected from others, even if everyone was a UK taxpayer. Gift Aid can’t be added to your donation if the donation is a company donation.

- For NZF to claim the tax you have paid on your donations, you must have paid income or Capital Gains Tax (in the UK) equal to the tax that will be claimed by all the charities that you donate to (currently 25p for every £1 you give) in the same tax year. By ticking the box, you agree that you are eligible to claim Gift Aid (as explained above) and that we can treat this donation, as well as any donations made in the last 4 years, and future donations, as Gift Aid, and that you understand that if you pay less Income Tax and/or Capital Gains Tax than the amount of Gift Aid claimed on all your donations in that tax year, that it is your responsibility to pay any difference.

I’ve given already

Can I have a statement of donations I’ve made to NZF?

- Yes, you can receive this by contacting us via this page here, and we’ll send over a PDF statement for your records.

What has happened to my login account?

- When we redeveloped our website, we had to suspend the account feature temporarily. This means you can’t access your calculation and donation history yourself at the moment. If you’d like a statement of your donations to NZF, please get in touch with us via this page here. Let us know your full name. We’ll send over a PDF statement for your records.

- We have also created a new calculation save feature which emails a copy of your calculation to you and provides a link for you to continue where you left off. You can try it out here: https://nzf.org.uk/zakat-calculator/ Just click on the ‘Save’ button at any time during your calculation.

I gave online but have not received a receipt

- We send the original receipt automatically to your email within a few minutes of your payment.

- Sometimes the email ends up in the junk/spam mail folder.

- If you would like a PDF copy of your giving receipt, please contact us here with your full name, date of giving, amount and type of giving

I made a business donation; how do I get a business receipt?

- Please get in touch with us via this page here with your company name and address. We will email you a PDF receipt in 2 working days.

Can I change my Zakat allocation preferences once I have donated?

- Yes, but only within 7 days. After 7 days we would have already allocated your donation to those in need based on your previous preferences. We can’t change it after this stage. Please get in touch here

I make a regular donation by Direct Debit. Can I change the amount I give?

- Yes, you can do this by contacting us on this page here. Please include your name, address and reference number if you have this. Let us know the new amount you would like to give and when you want this new arrangement to start. We will send you an email to confirm the change.

- You can cancel a Direct Debit at any time by simply contacting your bank or building society but please also notify us via this page here.

I’ve changed my mind about Gift Aid – what do I do?

- Please contact us on this page here with your full name and address. Let us know if: you are no longer eligible; or if you wish to cancel this declaration; or if you would like to change your name or home address; or if you no longer pay enough tax on your income and / or capital gain.

How do you distribute my Zakat?

When will my Zakat be given to people in need?

- We make sure your Zakat goes out to Muslims in need in the UK within 11.5 months (a lunar year).

- We’ll update you when that happens. For information on how we do this, check out this page here.

- People in need apply for Zakat throughout the year. So even though most of our donors like to give Zakat in Ramadan, we need to be able to give out Zakat funds to people in need throughout the year.

- This means that it might take a few months for your Zakat to be given out to people in need.

Do you help people who are on benefits? Aren’t benefits enough?

- We do help people on benefits. Sometimes, benefits are not enough for individuals and families who have been affected by a recent change in their living situation. Their situation can be made worse by external factors such as inflation in the price of food, fuel and utility bills.

Why do you use Zakat to also help those seeking education and training, not only those in great hardship?

- Every individual giving their Zakat through NZF can choose how much of their Zakat will go to help people in hardship, how much to people in need of housing or work support, and how much to community leaders/champions applying for financial help with education and training.

- A key aim of Zakat is to uplift the Muslim community and bring about positive, lasting change. Muslim religious leaders and other community champions who can help the Muslim community often want to invest in their training and development to benefit the community, but are held back by their financial circumstances. We give Zakat givers the opportunity to support them.

- All recipients are checked for Zakat eligibility before receiving funds

Will you publish details about the people you have funded through the Education Fund?

- You can choose which fund/s your Zakat goes towards.

- We are open about our Education Fund eligibility criteria and the way we distribute Zakat through that Fund. https://nzf.org.uk/apply/education-fund/.

- We give examples of how we support people using anonymised real-life case studies. We communicate these through email, social media and the website.

- We keep confidential details of specific individuals we’ve supported and how we have helped them, for their privacy. Islamic scholars and financial auditors check samples to make sure we are following processes properly.

Do you fund organisations as well as individuals?

- We no longer use Zakat income to fund institutions. Our focus is on helping individual Muslims in need. This makes practical sense and fits better with what our supporters have told us about their priorities.

How do you make sure those who apply genuinely need my Zakat?

- We understand how important it is to make sure Zakat givers can trust that their Zakat is being given out to those who genuinely need it and in a way which is religiously sound.

- We meticulously ensure that only applicants who should be receiving it are given Zakat. We take a proportionate approach, weighing up the cost and time of checks with the value of the financial support.

- For applicants to all funds, we check their identity. We insist applicants provide proof of their identity. We check their documentation is genuine.

- For applicants to all funds, we check their financial situation. We insist applicants provide bank statements or provide us access to their accounts via an Online Banking Portal. Again, we check they are genuine.

- If there is any doubt as to whether a person qualifies for Zakat based on the information they’ve given us, our experienced Grants Officers will ask the applicant more questions before making a decision.

- For applicants to the Education fund, where the value of financial support we give is higher, we make extra checks. We ask for references and check that the individual is aligned with the values of the organisation and does not pose a risk to the interests of the Muslim community.

- Independent scholars have checked and certified our Zakat policies and processes as religiously sound. See this page for our Certifications and Policies and you can view our Annual Reports here.

How can you be sure that the applicant discloses all the necessary information? Do you check whether they have other bank accounts or other adults in their household?

- As part of the application process, applicants have to provide 3 months of bank statements for all their accounts or provide us access to their accounts via an Online Banking Portal.

- We check bank statements provided for information which may indicate that the applicant has other accounts. These checks include:

- We check to see if any stated income (like benefits) are present in the bank statement provided. If they are not, we request bank statements for the account which is receiving the income.

- We check for any bank transfers made from the account to another account in the applicant’s name. This can indicate a savings account which has not been declared.

- We also request financial information about a person’s spouse so we can assess the situation of the family. Children above 18 are not included in the grant provided, however they can apply separately if they need help.

How do you ensure the safeguarding of applicants for Zakat?

- Our Safeguarding Commitment is publicly available. https://nzf.org.uk/safeguarding-policy-statement

- All staff have read and understood our Safeguarding policy. All staff have signed to that effect.

- All communication between NZF staff and applicants is by text, email, or phone. We record and log all text, email and phone interaction with applicants.

- If staff become aware of an issue, a staff member reports it to the Director of Operations who makes sure all relevant facts are identified and documented, takes agreed action in consultation with relevant people, and reports the incident to the Board. The Safeguarding Trustee is involved if/when needed.

- We have a complaints policy for applicants which is available on the website https://nzf.org.uk/applicants-complaints-policy/, which we follow.

What kinds of things does my Zakat help recipients with?

Your Zakat helps Muslims in need in the UK by providing them with:

- Cash support towards basic living costs like food, travel, clothing and monthly bills.

- Furniture

- Rent arrears & deposits

- Council tax arrears

- Moving and renovation costs

- Tools and work equipment

- Training course fees

- Learning resources

- Post-graduate education courses

- Vocational training

- And more!

How much Zakat do you give to a recipient?

- This varies depending on what fund the person in need has applied to. And exact amounts vary according to circumstances.

- If they’ve applied to Hardship Relief, we give at least 2 weeks’ support (based on the calculations of social change experts Joseph Rowntree Foundation), which is currently around £470 per person.

- If they’ve applied for Work or Housing support, we give up to £3,000.

- If they’ve applied for Education support, we give up to £10,000, direct to the course provider.

- We also let people in need know about other places they can go to get help. We work with other charities like Barnardos to help people access that support.

Is the money donated given in cash to the eligible recipients?

- For recipients applying to the Hardship Relief fund, Zakat is distributed to eligible recipients directly. For most recipients, we deposit in in their verified bank account. For recipients that don’t have a bank account, then we send them money through a registered referral agency that is looking after them or through the Post Office.

- For recipients applying to other funds, we give it directly wherever appropriate, or in kind (for example, furniture), or to the landlord (for rent), or to the relevant third party (e.g. for course fees).

How can I track my Zakat’s impact?

- Once your Zakat has been used to help Muslims in need through your chosen funds, you’ll get an email update from our ZakaTracker to tell you where it went and how it helped. Read more about this service here.

- Remember to check your Junk/Spam folder to ensure you receive all NZF updates, and add us to your safe senders list!